Demat Account

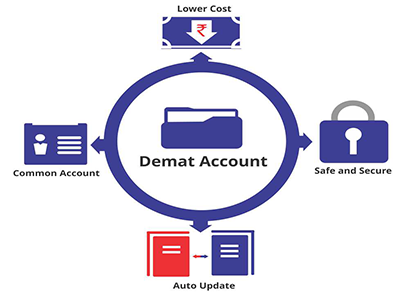

A demat account, short for dematerialized account, is an

electronic account that holds stocks, bonds, mutual funds,

and other securities in electronic form instead of physical

certificates. It serves as a centralized platform for

investors to store and manage their investment holdings

efficiently. By eliminating the need for physical paperwork

and storage of paper certificates, demat accounts offer

unparalleled convenience and security to investors.

Additionally, they enable seamless trading and investment

activities, allowing investors to buy, sell, and transfer

securities with ease.

Eligibility for Demat Account

To open a demat account, individuals typically need to meet

the following eligibility criteria:

-

Legal Age: The applicant must be of legal

age, usually 18 years or older.

-

Identity Proof: Valid identity proof such

as Aadhaar card, PAN card, passport, or voter ID card.

-

Address Proof: Valid address proof such

as Aadhaar card, passport, utility bills, or rent

agreement.

-

Income Proof: Some financial institutions

may require income proof for account opening.

Contact Us

Interested in opening a demat account? Contact us today to

explore your options or to learn more about our services.

Our team is here to assist you.